The Blockchain That Solves Everything (Except the Problem It Was Designed For)

The Blockchain That Solves Everything (Except the Problem It Was Designed For)

In which we explore how the technology meant to revolutionize money somehow became the answer to literally everything else, except making payments work.

The Great Blockchain Delusion

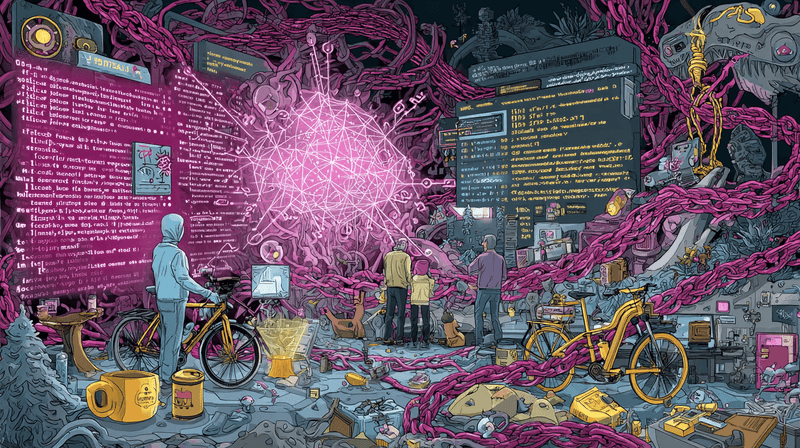

There’s a special kind of cognitive dissonance that occurs when you watch an industry collectively decide that the solution to every problem on Earth is a Merkle tree with commitment issues. Somewhere between Satoshi’s whitepaper and the current hellscape of NFT apes, blockchain technology underwent a remarkable transformation: from a specific solution to a very narrow problem into a magical cure-all that can apparently solve climate change, supply chain transparency, voting integrity, and, I kid you not, bad coffee.

The irony is so dense it could power a proof-of-work consensus mechanism. The technology designed to create peer-to-peer electronic cash has become everything except a practical way to buy coffee. But hey, at least you can now put that coffee bean’s entire life story on an immutable ledger that costs $50 in gas fees to update.

The Blockchain Hammer and the World of Nails

Supply Chain “Transparency” (Or: How I Learned to Stop Worrying and Love 500ms Query Times)

Let’s start with supply chain management, because nothing says “efficiency” like requiring distributed consensus to track a banana from Ecuador to your local Whole Foods. Traditional databases, with their blazingly fast queries and reliable ACID properties, are apparently too pedestrian for tracking mangoes. What we need is a system that turns every shipment update into a small-scale energy crisis.

I recently encountered a startup pitching “farm-to-table transparency” via blockchain. Their demo showed how consumers could scan a QR code to see their tomato’s complete journey, stored forever on the Ethereum network. The gas fee for updating the tomato’s location from “warehouse” to “truck” was approximately $30. The tomato cost $2. Math was clearly not their strong suit.

But the real genius is in the architecture: instead of a simple PostgreSQL database that could handle millions of queries per second, they’ve created a system that requires mining consensus to confirm that yes, indeed, the lettuce has moved three feet to the left in the warehouse. It’s like using a Formula 1 car to deliver pizza. Technically impressive, but missing the point entirely.

Carbon Credits: Solving Climate Change, One Hash at a Time

Nothing quite captures the zeitgeist like using proof-of-work consensus to track carbon offsets. It’s the technological equivalent of installing a coal power plant to run your solar panel monitoring system. The carbon footprint of recording your carbon reduction efforts exceeds the carbon you’re trying to offset, creating a beautiful recursive loop of environmental virtue signaling.

I’ve seen proposals for blockchain-based carbon credit marketplaces that would require more electricity to operate than most developing nations consume. The pitch decks invariably feature buzzwords like “immutable environmental accountability” and “decentralized climate action,” carefully omitting the fact that Bitcoin’s annual energy consumption could power Switzerland.

Voting: Democracy, Now With 51% Attack Vectors

Electronic voting is a solved problem in the same way that juggling chainsaws is a solved problem. Technically possible, but why would you want to? Enter blockchain voting systems, which take the simple concept of “count the votes” and transform it into “achieve distributed consensus on vote totals while maintaining voter privacy and preventing double-spending attacks.”

Estonia’s e-Residency program gets trotted out as proof that blockchain voting works, conveniently ignoring that their system actually uses traditional PKI and digital signatures. But facts have never stopped a good blockchain pitch. I’ve sat through presentations where founders explained how their voting smart contract would “revolutionize democracy” while glossing over minor details like key management, voter verification, and the fact that their test network had been 51% attacked twice in the past month.

Real Estate: Because Property Ownership Wasn’t Complicated Enough

The real estate industry, notorious for its embrace of cutting-edge technology and streamlined processes, was clearly crying out for blockchain disruption. Why settle for simple title deeds when you can tokenize property ownership and fragment it across seventeen different DeFi protocols?

I encountered a project that was tokenizing individual rooms in apartments, allowing “fractional ownership of living spaces.” The smart contract was 3,000 lines of Solidity, had three known reentrancy vulnerabilities, and required gas fees that exceeded most people’s monthly rent. But hey, at least the bathroom shares were liquid.

The Technical Reality Behind the Hype

Performance: The Elephant in the (Distributed) Room

Let’s talk numbers, because blockchain enthusiasts prefer not to. Visa processes about 1,700 transactions per second on average, with the capacity to handle 65,000 TPS during peak periods. Bitcoin, the grandfather of blockchain, manages a whopping 7 TPS. Ethereum, with all its smart contract sophistication, clocks in at around 15 TPS.

This is not a rounding error. This is not a temporary limitation. This is the fundamental reality of distributed consensus: the more decentralized your network, the slower it becomes. It’s like trying to make a group decision via committee, except the committee has millions of members, half of them are trying to game the system, and every decision requires everyone to agree on the exact same version of reality.

Gas Fees: The Accidental Feature

Ethereum’s gas fee mechanism was supposed to prevent spam and resource abuse. Instead, it created a system where simple operations cost more than most people’s daily income. I’ve seen smart contracts where transferring a $10 token costs $50 in fees. It’s the technological equivalent of paying $50 in shipping for a $10 item from Amazon, except Amazon would actually deliver your package.

The beautiful irony is that gas fees make blockchain applications economically viable only for high-value transactions, the exact opposite of the “banking the unbanked” narrative that drives so much blockchain evangelism. Turns out that requiring $30 in fees to send $5 to your grandmother doesn’t quite solve financial inclusion.

Smart Contracts: Neither Smart Nor Contracts

Smart contracts are immutable code deployed to a blockchain, which sounds impressive until you realize that “immutable” means “impossible to fix when you inevitably discover bugs.” The DAO hack, the Parity wallet freeze, the countless DeFi exploits. They’re not edge cases, they’re the inevitable result of deploying financial software that can never be patched.

Traditional software development has evolved sophisticated practices around testing, code review, and gradual deployment. Smart contract development says “hold my beer” and deploys financial applications with the testing rigor of a weekend hackathon project. The result is a ecosystem where “getting rekt” is not just possible but statistically probable.

The Grift That Keeps on Giving

NFTs: Solving the Problem of Artificial Scarcity Artificially

Non-Fungible Tokens represent peak blockchain absurdity: using cryptographic proof to establish ownership of links to JPEGs stored on regular web servers. It’s like buying a certificate that says you own the Brooklyn Bridge, except the certificate costs $500 in gas fees and the bridge image might disappear if someone forgets to pay their hosting bill.

The entire NFT ecosystem is built on the premise that artificial scarcity has value, even when the thing being made scarce is infinitely copyable digital art. Right-click, save-as: the eternal nemesis of blockchain-based ownership. But pointing this out makes you a “no-coiner” who “doesn’t understand the technology.”

DeFi: Traditional Finance, But Worse

Decentralized Finance promised to remove intermediaries from financial services. Instead, it created a parallel financial system with all the same risks, none of the regulations, and the added bonus of smart contract vulnerabilities. It’s traditional finance speedrunning every historical financial crisis, from bank runs to flash crashes to outright fraud.

The DeFi total value locked (TVL) metric is particularly entertaining. It’s like measuring the success of a casino by how much money people have brought to gamble. The fact that much of this “value” consists of recursive loops of leveraged speculation on governance tokens doesn’t dampen the enthusiasm.

The Existential Blockchain Question

Here’s the uncomfortable truth that blockchain evangelists would prefer to avoid: for every blockchain use case, there’s a simpler, faster, cheaper solution that doesn’t require revolutionary technology. Need supply chain tracking? Use a database. Want to reduce payment friction? Improve existing payment rails. Looking for transparent governance? Try actually transparent governance.

The blockchain solution to any given problem is invariably slower, more expensive, and less reliable than the traditional alternative. But it has one crucial advantage: it sounds futuristic. It suggests that your startup is riding the wave of technological inevitability rather than just building yet another CRUD application.

The Future of Everything Except Payments

As I write this, there are probably seventeen new blockchain startups launching with pitches to revolutionize dental records, pet insurance, or municipal parking meters. Each one will raise millions of dollars, hire a team of Solidity developers, and spend eighteen months building a proof-of-concept that performs worse than a MySQL database.

The blockchain revolution has succeeded beyond its creators’ wildest dreams, just not in the way they intended. Instead of revolutionizing money, it revolutionized the art of technological misdirection. It’s created an entire industry dedicated to solving problems that weren’t actually problems, using technology that doesn’t actually work, funded by people who don’t actually understand either the problems or the technology.

Meanwhile, Bitcoin, the original blockchain application, remains about as useful for buying coffee as a chocolate teapot. But hey, at least the coffee bean’s carbon footprint is now permanently recorded on an immutable ledger. Progress.

The greatest irony of the blockchain era isn’t that it failed to revolutionize finance. It’s that it succeeded in creating the perfect metaphor for the modern tech industry: a system that’s impressive in theory, dysfunctional in practice, and somehow worth billions of dollars anyway. Now that’s what I call innovation.